Paddle

📈 Summary

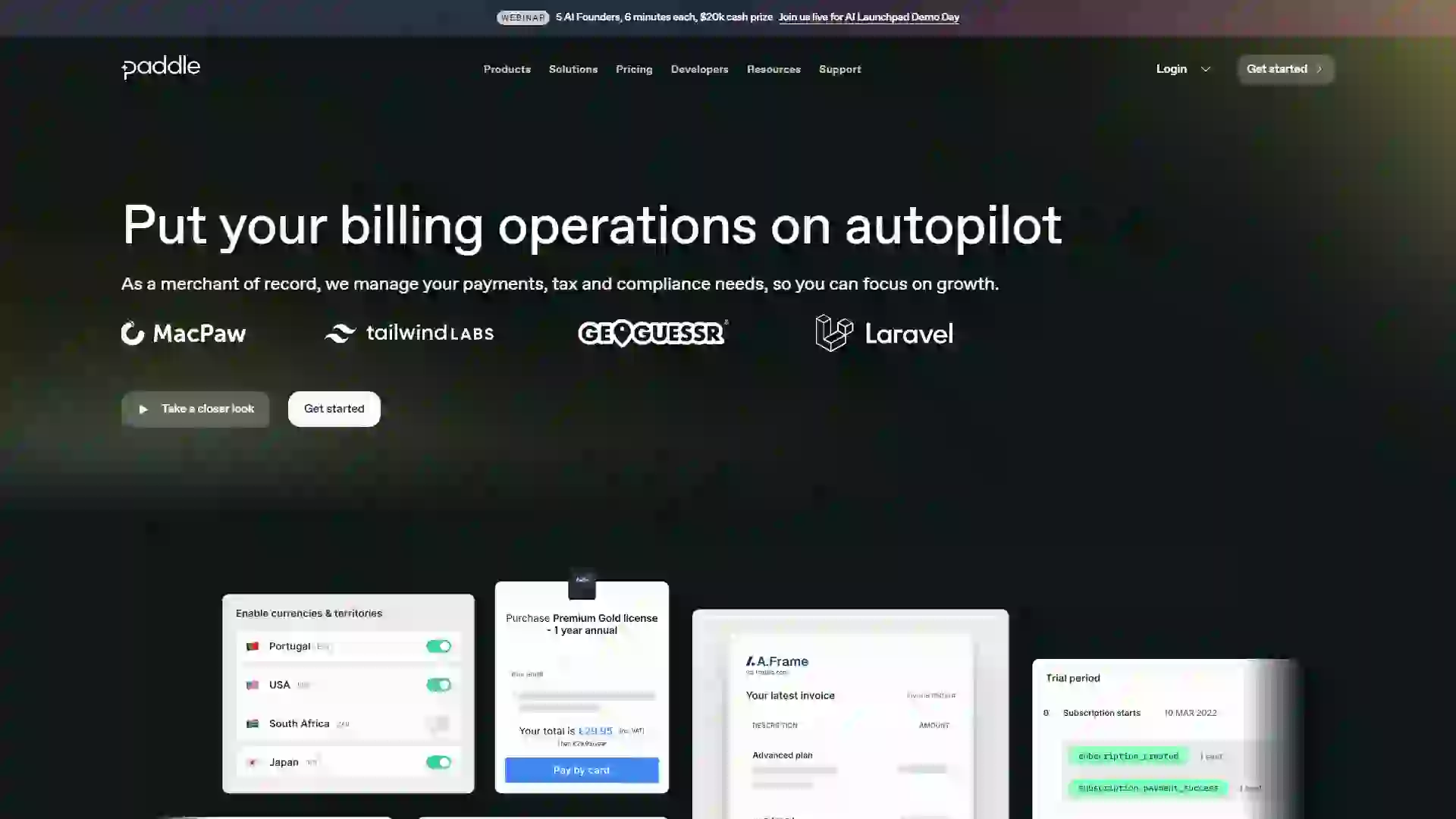

Paddle is a cutting-edge, low-fee payment infrastructure platform designed to streamline and automate billing operations. By offering an all-in-one solution, Paddle empowers businesses to focus on growth while eliminating the complexities of payment processing.

✨ Features

- Competitive Low Fees: Paddle provides highly competitive fee rates, significantly reducing payment costs for businesses.

- Unified Payments: Seamlessly integrates multiple payment methods to simplify the payment process and enhance user experience.

- Automated Billing: Fully automates invoice and billing processes, minimizing manual work and boosting operational efficiency.

- Global Reach: Supports multiple currencies and languages, making it ideal for international business expansion.

🎯 Use Cases

- SaaS Companies: Perfect for SaaS businesses managing large volumes of subscriptions and billing operations.

- E-commerce Platforms: Simplifies payment processes and enhances user payment experiences for e-commerce platforms.

- International Businesses: Ideal for companies requiring multi-currency and multi-language payment processing.

- Startups: Enables startups to quickly set up robust payment systems, allowing them to focus on business development.

⚠️ Drawbacks

- Limited Customization: Paddle may not be suitable for businesses requiring highly customized payment solutions.

- Learning Curve: New users may need some time to familiarize themselves with the platform's features.

- Support Response: Some users have reported occasional delays in customer support response times, which may impact issue resolution efficiency.

❓ FAQ

Q1: What are the main features and benefits of Paddle?

A1: Paddle offers competitive low fees, unified payment integration, automated billing, and global support for multiple currencies and languages. These features help businesses streamline operations, reduce costs, and expand internationally while focusing on growth.

Q2: How does Paddle compare to other payment platforms?

A2: Paddle stands out with its all-in-one solution, low fees, and automated billing capabilities. It is particularly advantageous for SaaS companies, e-commerce platforms, and international businesses. While some platforms may offer more customization, Paddle excels in simplicity and efficiency.

Q3: Are there any limitations to be aware of?

A3: Yes, Paddle may not be suitable for businesses requiring highly customized payment solutions. Additionally, new users may experience a learning curve, and occasional delays in customer support response times have been reported.

Paddle

Low-fee unified payment platform | Automates billing, supports global currencies